After decades of putrid and declining returns, the CD is gaining popularity once again due to recent increases in interest rates.

Why the fascination with CD’s? I would say most of the folks purchasing CD’s are looking for three things:

- Guaranteed Returns

- Safety

- Short Term Commitment

Purchased mostly by consumers either preparing for, or already in retirement, the first two items are clearly understandable. But there are both pro’s and con’s to the third reason. The pro is that your money isn’t held up for the long term. Should you run into a situation where you need access to those funds, usually you don’t have too long to wait until your current CD has run it’s course.

The biggest draw back of a CD being short term is that – so is the interest rate.

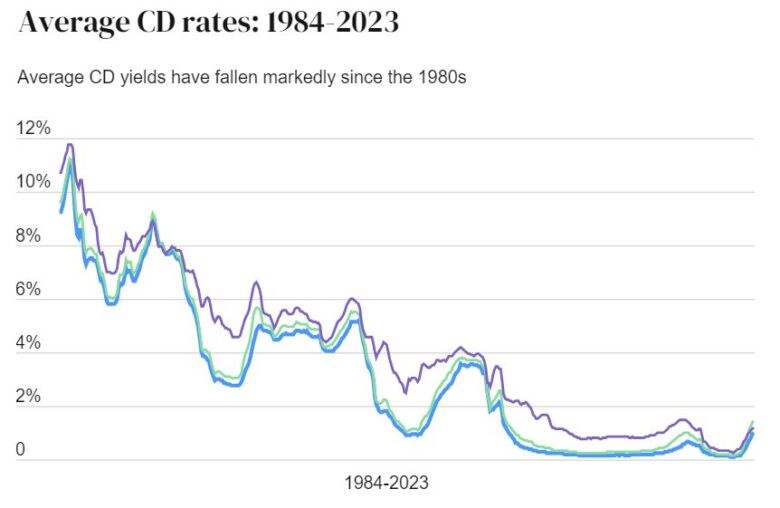

Given the historical interest rates of the CD going back to 1984, it seems very unlikely that the current higher interest rates will hold steady, meaning you won’t be able to count on that interest rate over the long term. The following chart from BankRate.com shows how much the CD has fallen over the last forty years:

So what may be a better option for those who are nearing retirement or are already retired?

If you don’t think you are going to necessarily need the money to live on, a great option would be a whole life insurance policy. While whole life insurance policies can be funded in a variety of means and schedules, we are going to focus on Single Premium Whole life so that we can compare it to a CD.

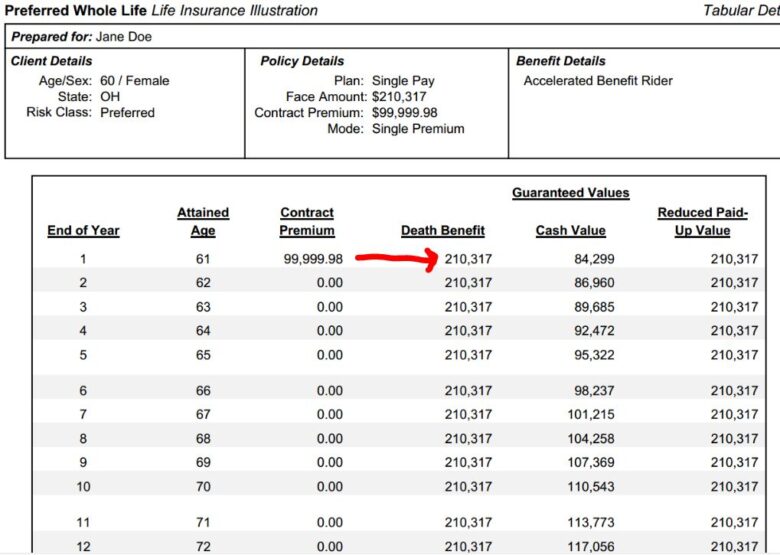

Jane Doe is a 60 year old healthy female. Jane has $100,000 set aside that she considers “never money”. Meaning, she never intends to need it. Instead, she wants to make sure that it goes to her grandchildren when she passes. Jane desires safety, security, and a reasonable return over the long term.

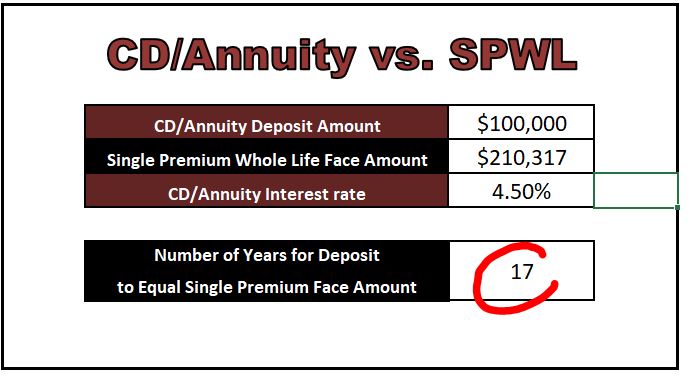

The longest term CD that I could find, with the highest interest rate was a five year CD via Barclays. That CD as of 09/21 is paying 4.5%. What happens after five years? We don’t know, which is certainly an issue as previously mentioned.

Jane is also in good health, and can easily qualify for Preferred rates for a Whole Life policy. She may even qualify for Super Preferred, but for this – we’ll stick with Preferred to be fair.

At age 60, at Preferred rates, a single premium whole life policy would turn Jane’s $100,000 into a tax free death benefit of $210,317 on Day 1.

So how would a CD fare? Ok, let’s pretend that 4.5% CD rate simply never expires.

It would take seventeen years , or age 77, until Jane’s CD balance equaled that of the tax free death benefit obtained on Day ONE through a Single Premium Whole Life policy.

Is this for everyone? Of course not. It all depends on what goals you are trying to accomplish, what funds you have on hand, and your health. But if you are trying to leave money to loved ones, trying to protect your estate from the high cost of a nursing home, or trying to leave a generational legacy or just leave money to charity – contact Beck Insurance Agency today. Call Beck Insurance in Archbold or Whitehouse, Ohio at 419-446-2777, send us an email at help@beckinsurance.com, or click here to submit your request.

Joseph D. Beck, CIC, CPRM, President